JobKeeper:

everything you need to know.

Updated 29 September, 2020 to include ongoing monthly reporting requirements and JobKeeper Extension.

Important Key Dates

28 September 2020

Submit monthly declaration reporting turnover amount for the JobKeeper Extension.

.

An overview

of JobKeeper.

To help guide you through this process we have compiled a step-by-step guide. If you are a Link payroll client, keep an eye out for an email from your bookkeeper.

- Under JobKeeper, businesses significantly impacted by COVID-19 will be able to access a subsidy from the Federal Government to support them in continuing to pay their employees.

- Eligible businesses will receive a subsidy of $1,500 per fortnight per employee for up to 6 months.

- The subsidy will be back paid to 30 March 2020, and payments will start flowing from early May 2020 for eligible businesses.

You can find more detail on JobKeeper here.

What do you need to do to get ready?

It is essential that you determine that your business is eligible to participate in JobKeeper AND that the employees you are nominating for JobKeeper are eligible to receive it.

4 steps to take before you

enrol for JobKeeper.

If you process your own payroll, here are the steps you must action immediately. As a Link client, we encourage you to reach out to us if you require any assistance in relation to JobKeeper or any other government stimulus. If you do require additional help please contact our resident JobKeeper expert, Thea, on 07 3899 8311 or complete our contact form below. Please action all the items you can ASAP so we may help you finalise any steps as necessary.

How to enrol for JobKeeper.

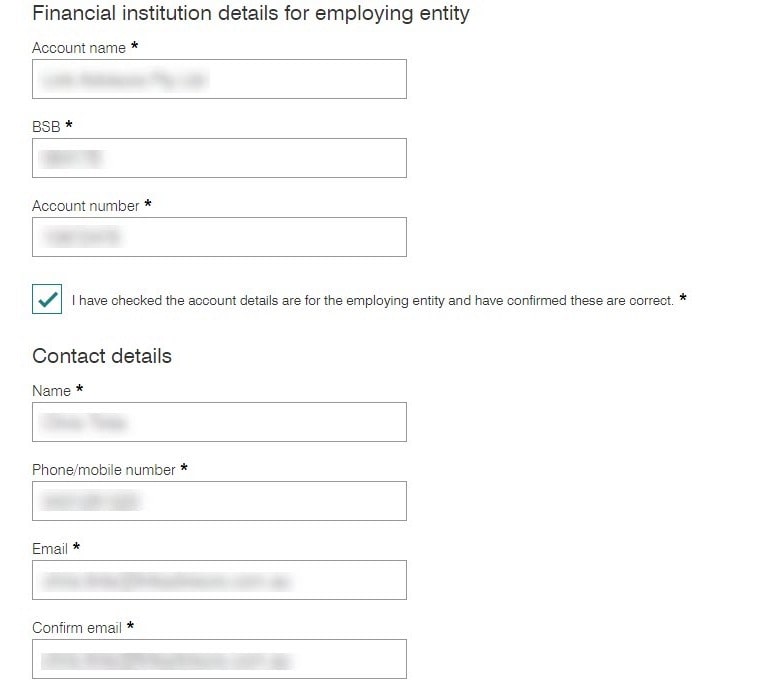

If you are wanting to access the first month of JobKeeper payments, then you will need to submit your enrolment application to the ATO via the Business Portal using your myGovID. If you don't already have a myGovID, click here to read our article to get it setup fast.

If you are wanting to get access to the first month of payments, you will need to lodge your application by 8 May 2020 (where you want to receive JobKeeper payments in May for April), with a further extension to 31 May 2020 (in this case JobKeeper payments for April, will not be received until June). The original due date was 26 April 2020. If you miss this deadline, you can still apply for the subsidy, but you won’t be eligible to receive payments for the month of April.

Access the Business Portal here.

Read our article on setting up myGovID here.

Here is what you need before you enrol:

- Know if you are an eligible business due to turnover reduction,

- Know how many eligible employees that you employ, and;

- Complete the employee nomination notices that can be found here (Employer Declaration and Employee Nominations).

Refer to our handy JobKeeper eligibility and preparation guide here.

It is absolutely essential to ensure that your business is eligible to participate in JobKeeper. Your decision must be considered and documented to ensure that things stack up if the ATO wanted to verify your eligibility in the future.

Many businesses (particularly those which have had to cease operation) will be obviously eligible, but for many more, it may not be obvious that they have or have not met the 30% decline in revenue requirement. Also, there are a handful of criteria for employees to satisfy which means that not all your staff may, in fact, be eligible.

If you need our support with JobKeeper, we’re here to help. We’re charging discounted fees for this essential service to provide as much help as possible to those who need it, and to also keep our team working full time to support our small business clients.

If you are a Link client, send us an email letting us know you have enrolled & attach a copy of your enrolment form. This means if we need to get involved with your application we have the details on hand. Send your enrolment form to your bookkeeper or advisor.

As you can see, the enrolment process is fairly straight forward.

On the other hand, determining if your business and employees are eligible for JobKeeper can be far from straight forward. As mentioned at the outset, it is essential that you determine that your business is eligible to participate in JobKeeper AND that the employees you are nominating for JobKeeper are eligible to receive it.

If you would like assistance from Link in relation to eligibility, enrolment or anything else JobKeeper, please reach out to us here.

*Please login to Xero to access this

Once you have

enrolled for JobKeeper.

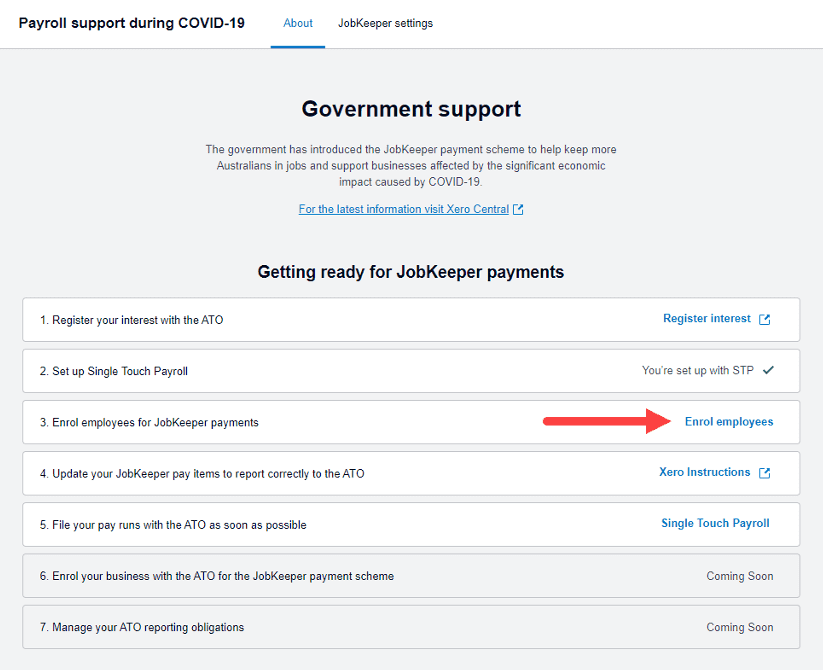

Keep your Xero books up to date.

You will be required to report sales each month so it is essential that your Xero file is regularly updated so you can lodge your figures ASAP after the end of each month.

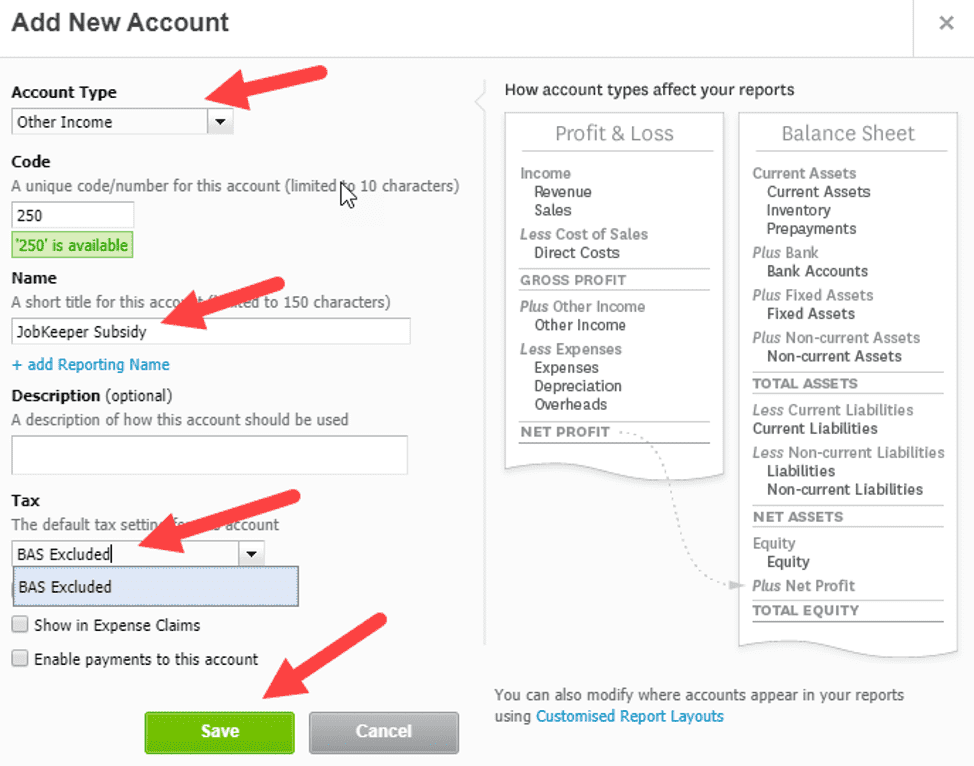

Ongoing monthly reporting to the ATO

The form includes many questions that are the same or similar to those which you completed when you enrolled. Take the opportunity to make sure you are 100% certain of the answers when you complete it this time.

Before you start

Ensure you have all the necessary documentation you require for the monthly declaration prior to starting as you cannot save and come back later. Information you will need is;

- Name, Tax File Number (TFN) and date of birth details for any additional employees and business participant

- Actual GST turnover for this month (make sure Xero is up to date!) and projected GST turnover for next month.

- Confirm you still satisfy eligibility as a business and that your employees are eligible (and you have a signed, completed employee nomination for each employee)

JobKeeper Update: Announcement of JobKeeper Extension to March 2021

On 21 July, the Federal Government announced that its extending JobKeeper until 28 March 2021 while introducing refinements to ensure that it is targeted to support those organisations which continue to be significantly impacted by COVID-19.

Existing JobKeeper payments and eligibility

Firstly, note that there is no change to JobKeeper (payments or eligibility) up to 30 September 2020. This is great news for all businesses currently eligible for JobKeeper. Even if your business is starting to recover, you’ll remain eligible to the end of September as was originally announced.

Changes announced 21 July 2020, effective from October 2020 to March 2021

JobKeeper payments post September 2020 are being referred to as the JobKeeper Extension. So, for this article we will use this name when referring to JobKeeper post September 2020.

If your business is still being adversely affected by COVID-19, then it’s likely you may be eligible for the JobKeeper Extension.

From 28 September 2020, eligibility for the JobKeeper Payment will be based on actual turnover in the relevant periods. The payment will also be stepped down and paid at two rates. Relevant date of employment will move from 1 March to 1 July 2020, increasing employee eligibility for the existing scheme and the extension.

Full details of the JobKeeper Extension can be found here.

Action required for the JobKeeper Extension

What to do if you are not eligible for JobKeeper Extension

- Submit your monthly JobKeeper declaration for September ASAP after 30 September 2020 as per usual. The sooner you get this lodged, the sooner you will receive your final JobKeeper payment.

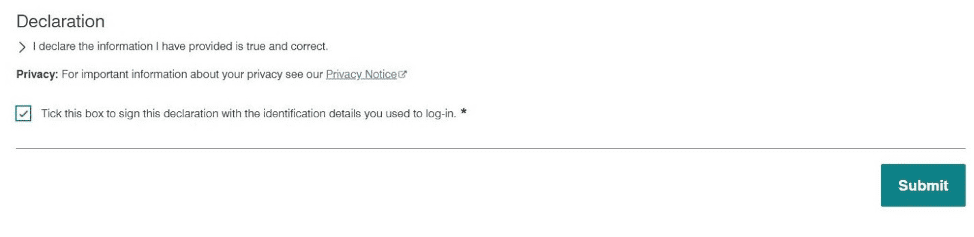

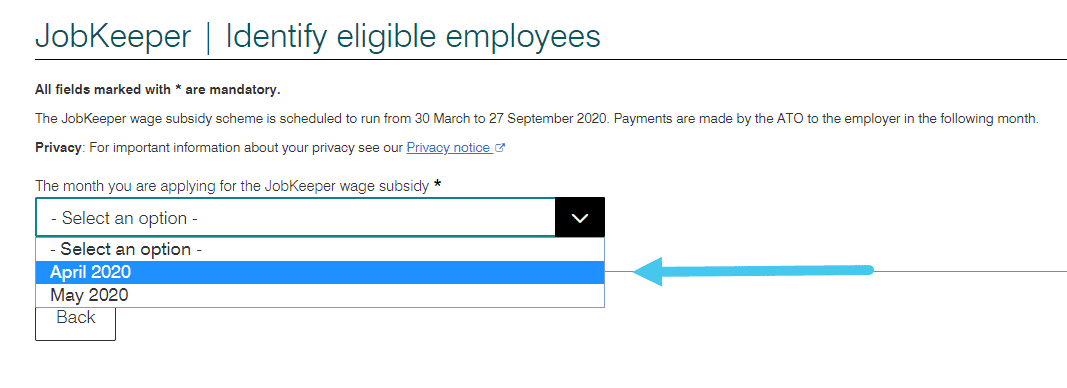

- In Xero, Click Payroll > Overview > Payroll Support Page > Enrolment Settings

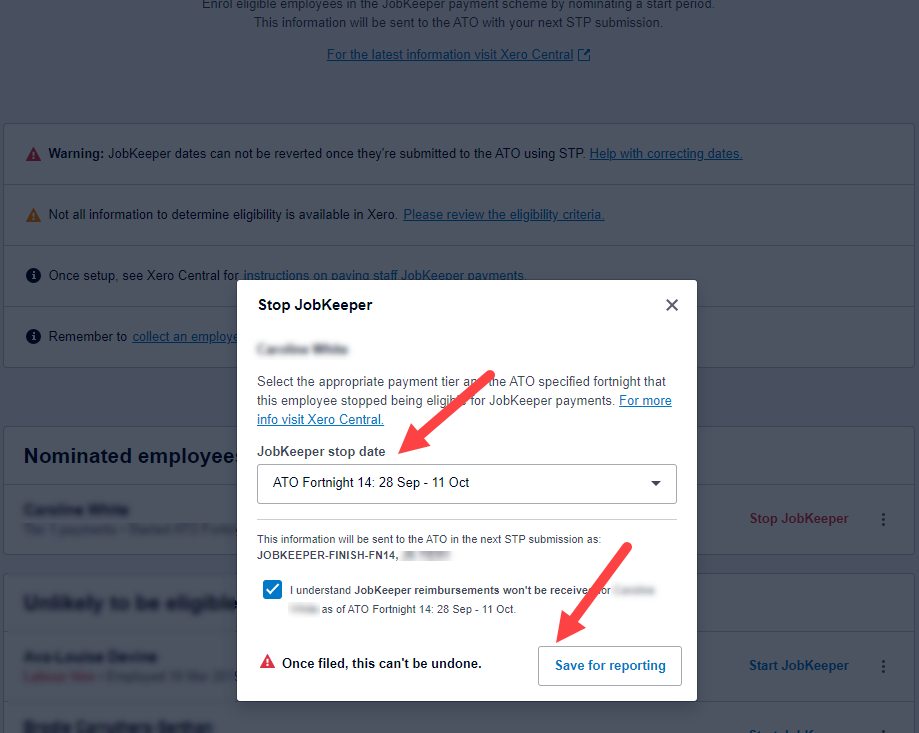

- For each employee enrolled in JobKeeper, press the Stop JobKeeper button and specify the stop date to be ATO fortnight 14. Click Save for Reporting. This will tell the ATO (when you next run payroll) that the employee is no longer eligible for JobKeeper from fortnight 14 onwards (ie from the start of the JobKeeper Extension period).

What to do if you are eligible for the JobKeeper Extension

- Submit your monthly JobKeeper declaration for September ASAP after 30 September 2020 as per usual. The sooner you get this lodged, the sooner you will receive your JobKeeper payment for September.

- There is no need to re-enrol for the JobKeeper extension, but a couple of tweaks are required in Xero going forward.

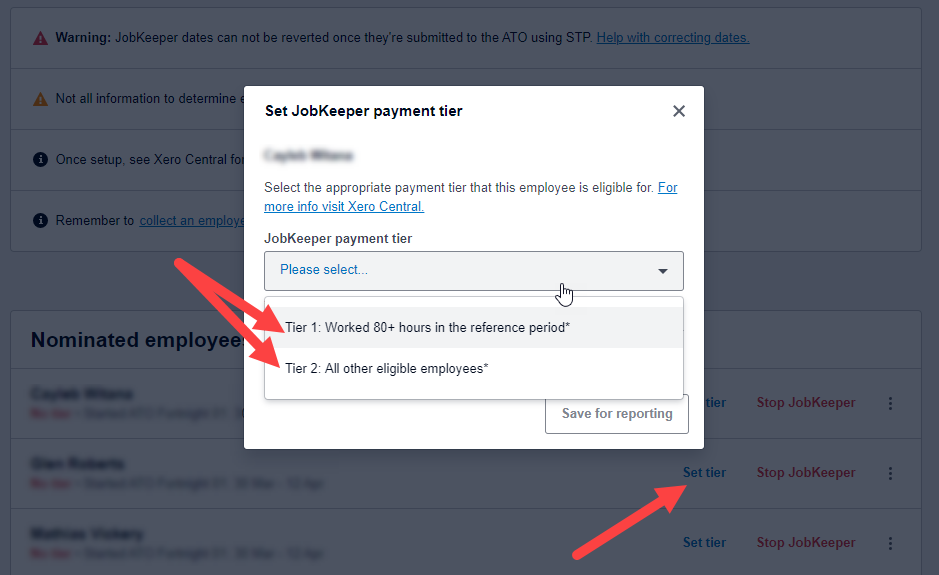

- Set the correct Tier for the JobKeeper extension for each employee

- In Xero, Click Payroll > Overview > Payroll Support Page > Enrolment Settings

- For each employee enrolled in JobKeeper, press the Set Tier button and specify the correct Tier for that particular employee.

- The tier will determine the amount of JobKeeper which will be paid for that particular employee. Refer to the table below.

- When determining the tier for each employee. You need to establish if they were working at least 80 hours in a 28 days period ending 1 March 2020 OR 1 July 2020 – if yes, then they are entitled to the Tier 1 payment (the higher amount). If not (ie they are casual or part time), then they will be entitled to Tier 2 (the lower amount)

- Click Save for Reporting.

- This will tell the ATO (when you next run payroll) that the employee is still eligible for JobKeeper from fortnight 14 onwards (ie from the start of the JobKeeper Extension period).

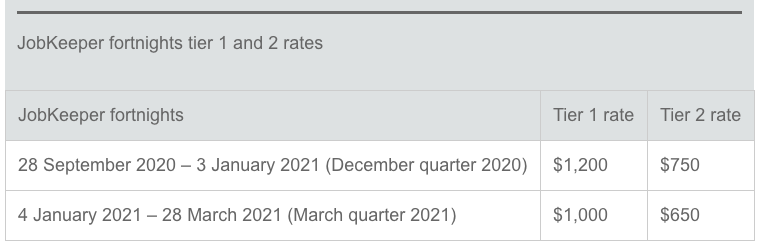

- Where you are paying a JobKeeper topup (because the particular employee is not working sufficient hours to exceed the minimum payment required under JobKeeper), be sure to adjust the topup based on the new JobKeeper rates in the table below. Previously you were required to ensure eligible staff were paid at least $1,500 per fortnight… this will reduce down to $1,200 per fortnight for tier 1 and $750 per fortnight for tier 2 in the December 2020 quarter…. And further reduce down to $1,000 per fortnight for tier 1 and $650 per fortnight for tier 2 in the March 2021 quarter.

Payment Tiers

Tier 1 and tier 2 rates

For JobKeeper fortnights from 28 September 2020, there are two payment rates – a tier 1 (higher) rate and a tier 2 (lower) rate.

The rate will be stepped down in two stages. The first payment rate decrease starts from JobKeeper fortnight 14 (28 September 2020). A further payment rate decrease starts from JobKeeper fortnight 21 (4 January 2021).

Entitlement to the tier 1 or tier 2 rate is based on whether an individual meets the 80-hour threshold.

Need Help?

If you require assistance with JobKeeper or JobKeeper extension, reach out to Link so we can guide you through it.

Need more help?

Although it is fairly straight forward to enrol a business for JobKeeper and to use Xero to notify the ATO of eligible employees, it is very often not straight forward to determine if the business AND its employees are in fact eligible for JobKeeper or the JobKeeper Extension.

It is critical that you correctly determine the eligibility of your business AND of your employees.

It is not enough to ‘assume a 30% decline’ nor is it enough to ‘assume employees are eligible’. You absolutely must undertake the exercise to calculate your decline in revenue to satisfy the test. Then you must consider every employee on your books and confirm they are eligible.

If you need any support with this, Link is here to help. This is how we are assisting small businesses with JobKeeper ;

- Helping to calculate revenue decline for eligibility

- Helping to determine employee eligibility and advising on the necessary documentation

- Enrolling businesses for JobKeeper

- Configuring and updating payroll records as necessary

- Taking care of ongoing reporting

Reach out to us ASAP if you need any assistance with JobKeeper or the JobKeeper Extension.

Let's connect

How can we help you?

Disclaimer

The information contained on this website is presented as a guide only and is not intended to replace professional advice relevant to your specific circumstances. While the information on this website has been verified to the best of our abilities, we cannot guarantee that there are no mistakes or errors. Link Advisors take no responsibility for any omissions, inaccuracies or loss incurred by reliance on this information.